Shariah-Compliant Debt Consolidation – A Better Future

Backed by 15+ years of expertise in Shariah-compliant personal financing across banks and cooperatives.

About Us

With over 15 years of experience in the banking and cooperative sectors, we specialize in Islamic personal financing products, supported by deep multi-product expertise and strong market segmentation insights. Serving both banks and selected cooperatives regulated by the Suruhanjaya Koperasi Malaysia (SKM), we deliver tailored, compliant, and customer-centric financial solutions that drive sustainable growth and promote financial inclusion. Our professional experience spans from 2009 to the present.

Our Services

Payslip Review

A comprehensive evaluation of Salary Deduction Ratio (SDR) and Debt Service Ratio (DSR) is performed for every customer prior to proposing appropriate financial products.

Analysing Customer Needs and Wants

We gather and analyse customer insights to understand their needs and wants, ensuring all marketing decisions are customer-driven before execution.

Screening Customer CTOS Report

With the customer’s consent, our company conducts a complimentary CTOS screening as part of the credit evaluation process to support responsible credit approval decisions.

Biro Pecahan Angkasa Checking

We also provide complimentary Biro Pecahan Angkasa and in transit checks for all customers, ensuring accurate monitoring and up-to-date information at no additional cost.

Benefits

Why Choose Us?

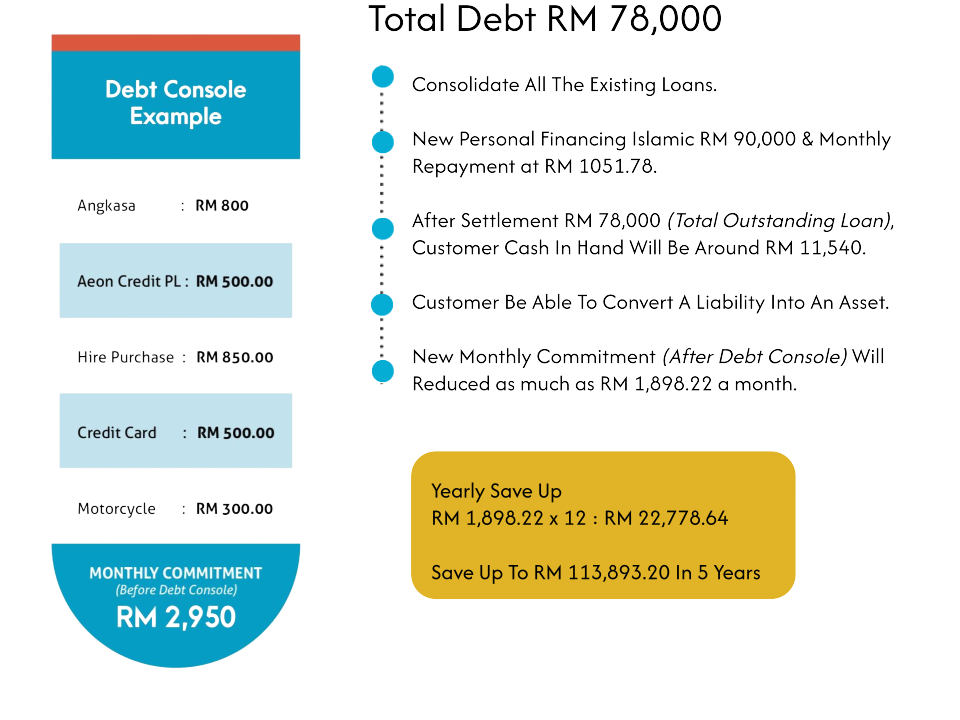

Debt Console Example